The semiconductor industry witnessed a remarkable year in 2023, experiencing its most significant surge in over ten years, reports Bloomberg.

This impressive growth was primarily driven by chip manufacturers, who are increasingly being recognized for their crucial role in the development and advancement of artificial intelligence (AI).

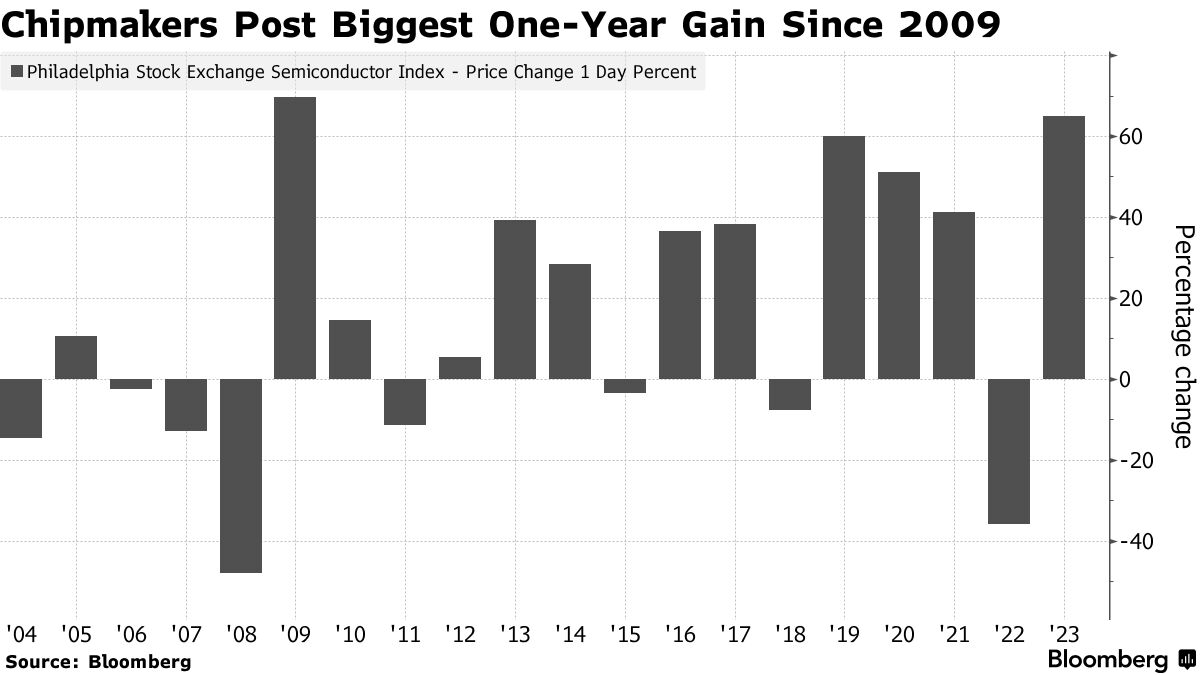

In an impressive display of market resilience, the Philadelphia Stock Exchange Semiconductor Index soared by 65% in 2023. This achievement marks the most substantial annual gain for the index since 2009. Back then, it had climbed by 70%, bouncing back from the lows of the financial crisis. Despite a slight dip of 0.8% on Friday, the index has been trading close to its all-time high, highlighting the robust and enduring nature of the semiconductor sector following the generative AI boom.

Nearly all stocks in the 30-member index experienced growth, but one company stood out from the rest with its extraordinary performance: Nvidia Corp. This tech giant saw a meteoric rise in sales, fueled by the escalating demand for chips essential for AI computations. Nvidia’s shares skyrocketed, more than tripling in value. This stellar performance crowned Nvidia as the first chipmaker to surpass the $1 trillion mark in market capitalization.

Not far behind in this race was Advanced Micro Devices Inc (AMD), another key player in the AI sphere and one of the biggest rivals to Nvidia. AMD’s stock witnessed an impressive ascent, soaring nearly 130% over the year.

In contrast to the overall success story of the semiconductor industry in 2023, Wolfspeed Inc. emerged as the exception. The company, known for manufacturing power modules integral to electric vehicles, saw its shares fall by 37% throughout the year. This decline was primarily attributed to a couple of underwhelming performance forecasts issued by the company, exacerbated by ongoing production challenges at one of its new facilities.

Meanwhile, stepping away from the industry’s benchmark index, ARM Holdings, renowned for its chip design in smartphones, made its foray into the public market in September. The initial phase of trading for ARM Holdings was marked by volatility, but the company has since seen a significant turnaround. Since hitting a low in October, ARM Holdings’ shares have rebounded remarkably, climbing almost 60%, indicating a robust and promising performance trajectory.