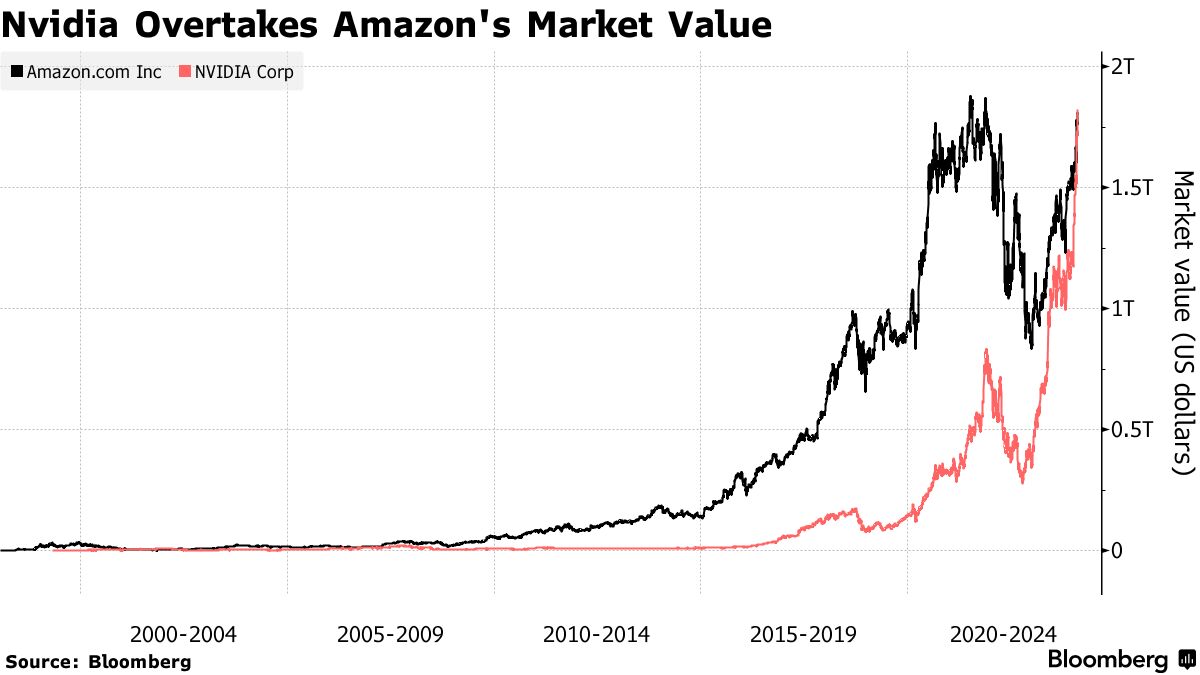

In a brief but significant financial turn of events on Monday, American chipmaker Nvidia momentarily ascended past Amazon in terms of market capitalization, highlighting a year of remarkable growth driven by the explosive demand for its artificial intelligence computing chips, largely used to train Large Language Models (LLM).

By the close of trading, Nvidia had edged up nearly 0.2%, achieving a market value close to $1.78 trillion. Conversely, Amazon experienced a 1.2% dip, concluding the day with a market capitalization of $1.79 trillion. This shift allowed the semiconductor giant to temporarily eclipse the market valuation of the retail and cloud computing behemoth, positioning Nvidia as the fourth most valuable company in the U.S. market, just behind Alphabet with a capitalization of $1.84 trillion. At the top of the market valuation leaderboard are Microsoft and Apple, with valuations of $3.09 trillion and $2.89 trillion, respectively.

Saxo Bank’s Peter Garnry said: “Amazon was actually among the winners in the current earnings season as Amazon’s outlook is improving. Nvidia is just riding the first investment wave of the current AI boom with massive capital expenditures being deployed in data centers.”

Nvidia’s stocks saw a massive surge at the start of 2024 after a period of limited growth throughout the second half of 2023. This explosive growth was driven by an unprecedented demand for its data center chips amid the AI boom created by the rise of ChatGPT. To put it into perspective, Nvidia has generated more market value in 2024 so far than the last 7 months of 2023. It added a total of $600 billion market cap during the period.

Amazon, on the other hand, is reporting positive financial figures as well. Thanks to strong sales during the fourth quarter of its fiscal year and a forecast of profitability that exceeded expectations, Amazon’s shares jumped by 8% last week. This allowed Amazon to briefly overtake Google’s parent company Alphabet in terms of market capitalization.

Nvidia stands as the final tech giant in the queue to announce its earnings, with the report anticipated on February 21, which should shed a more detailed light on the company’s financial standing.

Via: Bloomberg